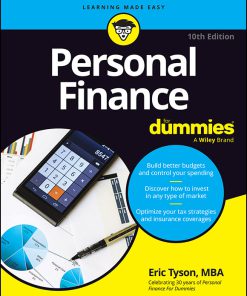

Personal Finance For Dummies 10th Edition by Eric Tyson ISBN 9781394207565 1394207565

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Personal Finance For Dummies 10th Edition by Eric Tyson – Ebook PDF Instant Download/Delivery: 9781394207565 ,1394207565

Full download Personal Finance For Dummies 10th Edition after payment

Product details:

ISBN 10: 1394207565

ISBN 13: 9781394207565

Author: Eric Tyson

Sound personal money management advice with insights for today’s world

Personal Finance For Dummies has been tackling financial literacy for 30 years. This tenth edition continues to share the sound advice that’s helped millions of readers become financially literate while demystifying the money matters of the current era. Get familiar with the financial pillars of earning, saving, investing, borrowing, budgeting, and protecting your assets. Dig into modern concerns like navigating the housing market, weathering the highs and lows of an unpredictable market, evaluating new stuff like cryptocurrency, and budgeting to achieve your financial goals. Take the anxiety out of money matters by building a solid financial plan, learning to spend and invest wisely, and managing your debt. Follow the advice that’s helped readers for three decades!

- Become financially literate so you can minimize debt and set realistic goals

- Learn the basics of investing and start making smart investment choices

- Demystify insurance so you can protect your health and your assets

- Control your spending and build better budgets so you can afford the big stuff

Personal Finance For Dummies offers sound advice for all ages and levels of personal money management. It’s never too early or too late to start making sense of your finances.

Personal Finance For Dummies 10th Edition Table of contents:

Part 1: Getting Started with Personal Finance

Chapter 1: Embracing Financial Literacy

Understanding Everything Financial Literacy Includes

Talking Money at Home

Identifying Unreliable Sources of Information

Jumping over Real and Imaginary Hurdles to Financial Success

Chapter 2: Establishing a Financial Foundation

Understanding Your Cash Flow

Utilizing Transaction and Investment Accounts

Budgeting to Boost Your Savings

Understanding and Improving Your Credit Score

Chapter 3: Measuring Your Financial Health

Avoiding Common Money Mistakes

Determining Your Financial Net Worth

Examining Your Credit Score and Reports

Knowing the Difference between Bad Debt and Good Debt

Analyzing Your Savings

Evaluating Your Investment Knowledge

Assessing Your Insurance Savvy

Chapter 4: Establishing and Achieving Goals

Creating Your Own Definition of Wealth

Prioritizing Your Savings Goals

Building Emergency Reserves

Saving to Buy a Home or Business

Funding Kids’ Educational Expenses

Saving for Big Purchases

Preparing for Retirement/Financial Independence

Part 2: Spending Less, Saving More

Chapter 5: Managing Where Your Money Goes

Examining Overspending

Assessing Your Spending

Chapter 6: Dealing with Debt

Using Savings to Reduce Your Consumer Debt

Decreasing Debt When You Lack Savings

Turning to Credit Counseling Agencies

Filing Bankruptcy

Stopping the Spending/Consumer Debt Cycle

Chapter 7: Reducing Your Spending

Unlocking the Keys to Successful Spending

Reducing Your Spending

Chapter 8: Managing and Reducing Your Taxes

Understanding the Taxes You Pay

Trimming Employment Income Taxes

Increasing Your Deductions

Reducing Investment Income Taxes

Enlisting Education Tax Breaks

Getting Help from Tax Resources

Dealing with an Audit

Part 3: Building Wealth through Investing

Chapter 9: Considering Important Investment Concepts

Establishing Your Goals

Understanding the Primary Investments

Shunning Gambling and Get Rich Quick Vehicles

Understanding Investment Returns

Sizing Investment Risks

Diversifying Your Investments

Acknowledging Differences among Investment Firms

Seeing Through Experts Who Predict the Future

Leaving You with Some Final Advice

Chapter 10: Understanding Your Investment Choices

Slow and Steady Investment: Bonds

Building Wealth with Ownership Vehicles

Off the Beaten Path: Investment Odds and Ends

Chapter 11: Investing in Funds

Understanding the Benefits of Mutual Funds and Exchange-Traded Funds

Exploring Various Fund Types

Selecting the Best Funds

Deciphering Your Fund’s Performance

Evaluating and Selling Your Funds

Chapter 12: Investing in Retirement Accounts

Looking at Types of Retirement Accounts

Allocating Your Money in Retirement Plans

Transferring Retirement Accounts

Chapter 13: Investing in Taxable Accounts

Getting Started

Understanding Taxes on Your Investments

Fortifying Your Emergency Reserves

Investing for the Longer Term (Several Years or Decades)

Chapter 14: Investing for Educational Expenses

Exploring Higher-Education Options

Figuring Out How the Financial Aid System Works

Strategizing to Pay for Educational Expenses

Investing Educational Funds

Chapter 15: Investing in Real Estate: Your Home and Beyond

Deciding Whether to Buy or Rent

Financing Your Home

Finding the Right Property

Working with Real-Estate Agents

Putting Your Deal Together

After You Buy

Part 4: Insurance: Protecting What You Have

Chapter 16: Insurance: Getting What You Need at the Best Price

Discovering My Three Laws of Buying Insurance

Dealing with Insurance Problems

Chapter 17: Insurance on You: Life, Disability, and Health

Providing for Your Loved Ones: Life Insurance

Preparing for the Unpredictable: Disability Insurance

Getting the Care You Need: Health Insurance

Chapter 18: Covering Your Assets

Insuring Your Home

Auto Insurance 101

Protecting against Mega-Liability: Umbrella Insurance

Planning Your Estate

Part 5: Where to Go for More Help

Chapter 19: Working with Financial Planners

Surveying Your Financial Management Options

Deciding Whether to Hire a Financial Planner

Finding a Good Financial Planner

Interviewing Financial Advisors: Asking the Right Questions

Learning from Others’ Mistakes

Chapter 20: Using Technology to Manage Your Money

Surveying Software, Apps, and Websites

Accomplishing Money Tasks on Your Computer, Tablet, or Smartphone

Chapter 21: Consuming Financial Content

Observing the Mass Media

Rating Radio, Podcasts, and Television Financial Programs

Finding the Best Websites

Navigating Newspapers and Magazines

Betting on Books

Part 6: The Part of Tens

Chapter 22: Survival Guide for Ten Life Changes

Starting Out: Your First Job

Changing Jobs or Careers

Getting Married

Buying a Home

Having Children

Starting a Small Business

Caring for Aging Parents

Divorcing

Receiving a Windfall

Retiring

Chapter 23: Ten Tactics to Thwart Identity Theft and Fraud

Save Phone Discussions for Friends Only

Never Respond to Emails Soliciting Information

Review Your Monthly Financial Statements

Secure All Receipts

Close Unnecessary Credit Accounts

Regularly Review Your Credit Reports

Freeze Your Credit Reports or Place an Alert

Keep Personal Info Off Your Checks

Protect Your Computer and Files

Protect Your Mail

Glossary

Index

People also search for Personal Finance For Dummies 10th Edition:

other books by the author of personal finance for dummies

canadian personal finance for dummies

personal finance for dummies table of contents

personal finance for dummies reddit

personal finance for dummies audiobook

Tags:

Eric Tyson,Personal Finance,Dummies

You may also like…

Business & Economics - Small Business

Business & Economics - Accounting

Taxes For Dummies 2024th Edition by Eric Tyson, Margaret Atkins Munro ISBN 1394226454 9781394226450

Business & Economics - Personal Finance

Personal Finance For Dummies 10th Edition by Eric Tyson ISBN 9781394207565 1394207565

Business & Economics - Professional Finance

Corporate Finance For Dummies (For Dummies (Business & Personal Finance)), 2nd Edition Taillard

Business & Economics - Investing

Business & Economics - Personal Finance

Business & Economics - Small Business

Business & Economics - Investing

Hedge Funds For Dummies (For Dummies-Business & Personal Finance) Logue

Business & Economics - Personal Finance